It appears the conditional use zoning permit application for the proposed Synergen Green Energy ammonia production plant won’t come before the Hamilton County Board of Commissioners until possibly sometime in June at the earliest. At the commission’s regular meeting on Monday the board had proposed…

It appears the conditional use zoning permit application for the proposed Synergen Green Energy ammonia production plant won’t come before the Hamilton County Board of Commissioners until possibly sometime in June at the earliest.

News

For the past six months, just the daily task of putting one foot in front of the other has been an important milestone in Marsha Mills’s journey to recovery.…

Ross Lyon chose Giltner as a place to move his family when he was working as a drug investigator with the Nebraska State Patrol in 2013, and 11 years later he…

Graham Christenson has a different perspective than most after this year’s state FBLA conference in Kearney. The Aurora senior competed like many of his fellow…

Ag Life

The African country of Kenya is a long ways from the corn and soybean fields of Hamilton County. In fact, it took local farmer Brandon Hunnicutt more than 30…

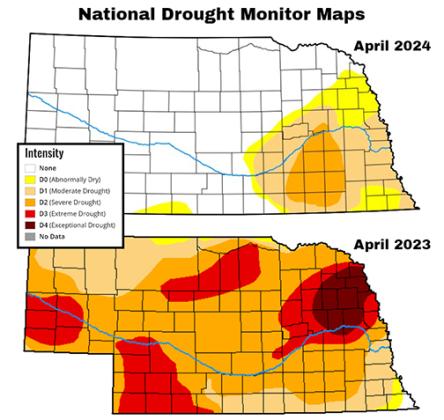

“We aren’t out of the woods by any means on the drought. We’re better, but we’re just sort of hanging in there right now.”So says National Weather Service (NWS…

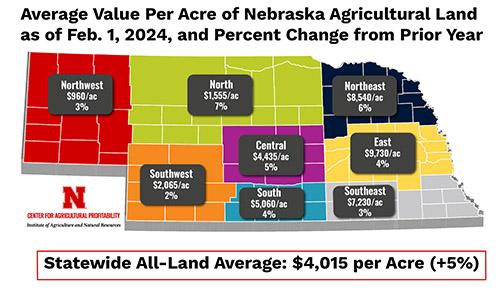

The market value of agricultural land in Nebraska is up in 2024, however, the state’s farm income is projected to fall this year, according to recent articles…

Sports

News Staff

Despite the wind advantage in the second half, the Huskies were unable to find the net. In the end, a superb defensive performance meant a second goal wasn’t…

News Staff

Charlie Evans waited, paused and held back a bit more during a tense 1600 race late Monday afternoon.Once the pay window opened up in the final 200 meters,…

News Staff

The 100 meter dash final at last week’s High Plains Invite featured a lot of local flavor.Of the eight lanes, four of them were occupied by area ANR athletes…