In early February of last year an article in the News-Register reported the rather alarming news that due to declining attendance, Aurora’s 12th Street Theater, run by the non-profit Hamilton Recreation, might be on the verge of closing after a 30-year run. Today, 14 months later there is no talk…

In early February of last year an article in the News-Register reported the rather alarming news that due to declining attendance, Aurora’s 12th Street Theater, run by the non-profit Hamilton Recreation, might be on the verge of closing after a 30-year run.

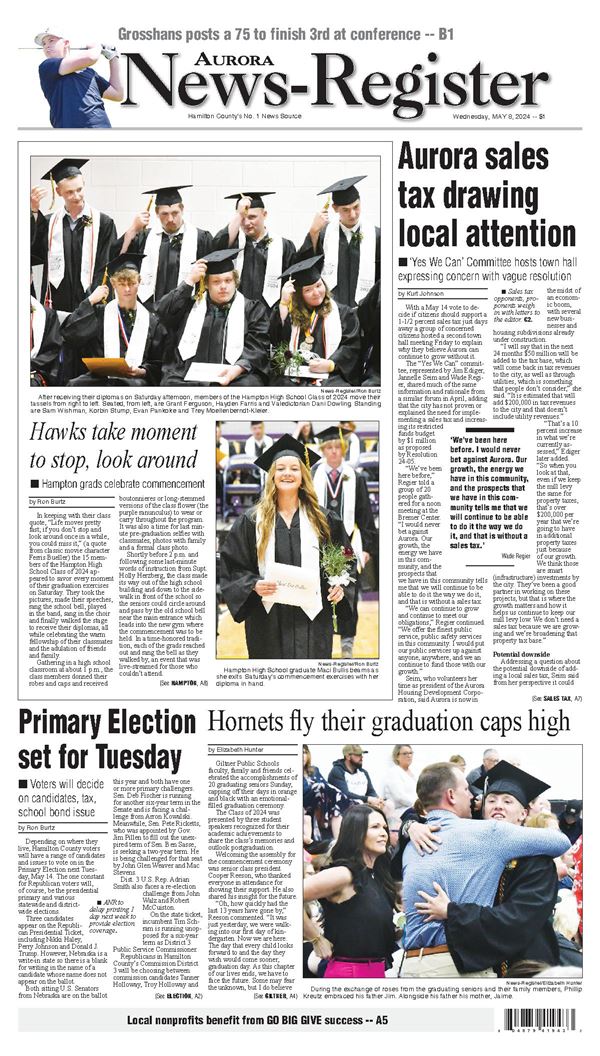

News

Several dozen upcoming county highway projects were the subject of discussion Monday at the weekly Hamilton County Board of Commissioners meeting. The board…

The HPC school board received an update from the school’s Teammates chapter during Monday’ regular monthly meeting.Karen Benner, the chapter coordinator since…

Former Dist. 34 Sen. Curt Friesen spoke up at a meeting Thursday in Aurora focused on the proposed Aurora city sales tax, saying he felt compelled to clarify…

Ag Life

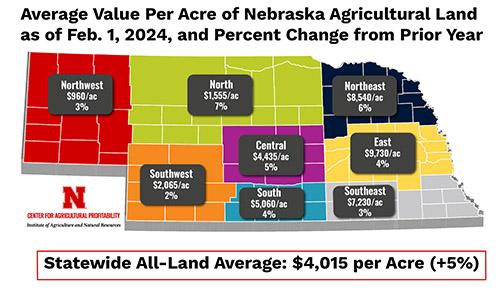

The market value of agricultural land in Nebraska is up in 2024, however, the state’s farm income is projected to fall this year, according to recent articles…

When farmers first began to till the Nebraska sod more than 150 years ago, a horse and plow were considered essential equipment. Then it was a gas-powered…

The presence of the large Syngenta facility along Highway 34 west of Aurora and busloads of high school students heading to the fields each summer for…

Sports

News Staff

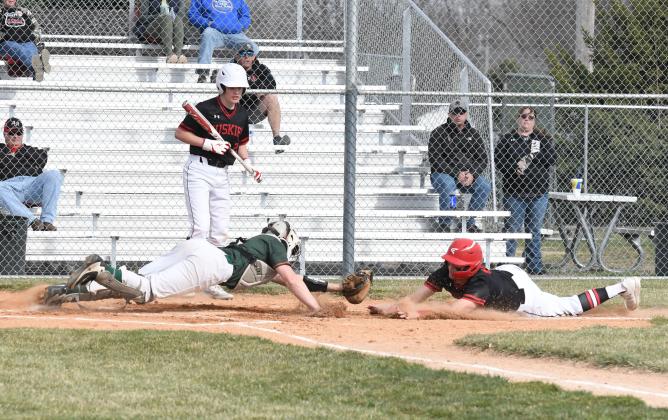

The first one is sometimes the hardest one to come by. Aurora’s baseball team doesn’t need to fret about that anymore.The Huskies earned its first win in…

News Staff

The Husky boys soccer team wasn’t really interested in playing extra soccer with wild wind conditions.After a disastrous two minutes for the Huskies in which…

News Staff

It was quite the welcomed moment for Ethan Ramaekers. The Aurora senior marked a new PR at Thursday’s Norris Invite, clearing 6-4 in the high jump in a…